Since 2018, Blackfinch Asset Management has been running its Managed Portfolio Service (MPS), a range of award-winning multi-asset portfolios that are actively managed, globally diversified and cover a range of risk profiles.

The success of this range gave Blackfinch the opportunity to develop a separate offering for advisory firms: the Tailored Portfolio Service, which was launched earlier this year.

While these two services have several similarities, the differences between the two are just as important for advisers to understand, especially if they are looking to determine which approach is right for them.

The Blackfinch Managed Portfolio Service (MPS)

When the investment team created the Blackfinch MPS, they began with the belief that most investors share similar aspirations and objectives in terms of what they want from their investments, namely to preserve and grow capital in real terms over the medium to long term.

The team felt it was important to develop a portfolio range with clearly-stated investment objectives, and easy to understand return targets. This helps the investment team to measure the performance of all the investments more accurately, and also helps advisers to develop a more precise cash flow model for their clients.

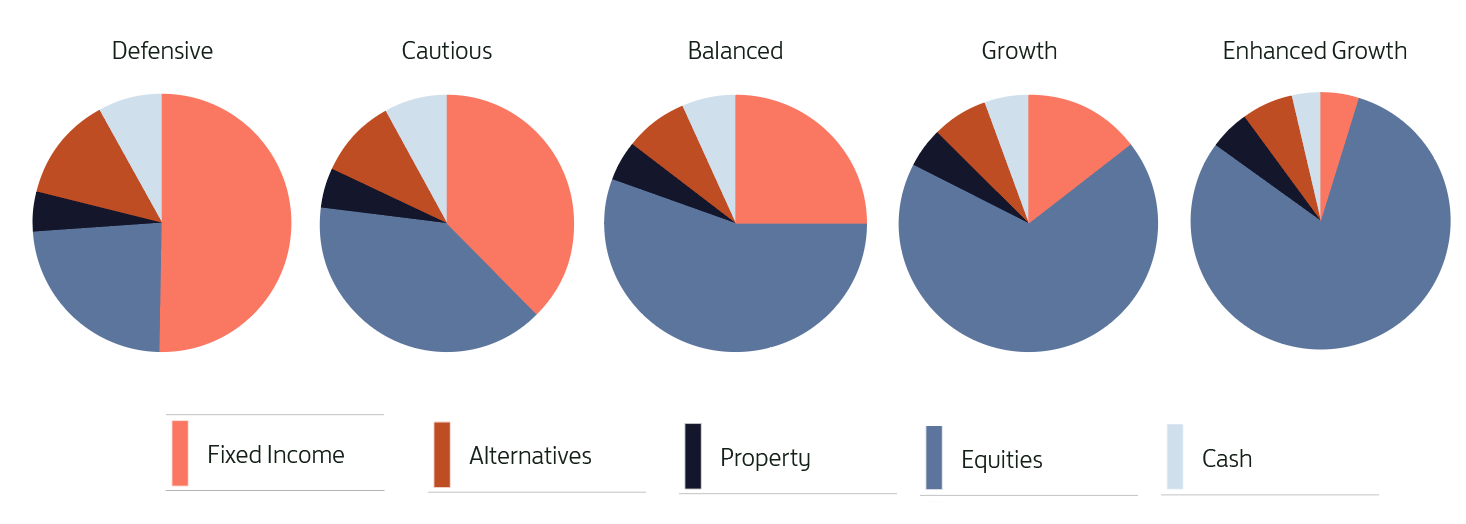

As a result, the Blackfinch MPS features five investment portfolios with return targets linked to inflation as measured by the Consumer Prices Index (CPI). The five portfolios are below, listed net of fees:

- Defensive – which has a rolling five-year target return of CPI+1%

- Cautious – which has a rolling five-year target return of CPI+2%

- Balanced – which has a rolling five-year target return of CPI+3%

- Growth – which has a rolling five-year target return of CPI+4%

- Enhanced Growth – which has a rolling five-year target return of CPI+5%

By targeting above-inflation returns from a range of investments, the MPS provides investors with a clearer understanding of the investment journey they can expect. Blackfinch uses the CPI inflation target as it provides investors with a true reflection of the way in which the ‘real’ value of their money will change over time.

The investment team at Blackfinch has a strong focus on sustainability and responsibility and considers Environmental, Social and Governance (ESG) factors in the investments it makes across all its portfolios. The team believes that investing in companies strongly aligned with ESG considerations can lead to superior returns, and that there’s a strong correlation between companies which improve their ESG factors and share price performance.

They adopt an approach where positive screening is key, and seeks to invest in firms making a material effort to improve their policies and engagement efforts around ESG factors. To be clear, Blackfinch does not exclude or ‘negatively screen’ out any specific sectors or industries, rather the investment team carries out thorough research as part of their investment process to identify funds with positive ESG factors and targets to consider for investment.

The Blackfinch Tailored Portfolio Service

While our Tailored Portfolio Service is a new product in a rapidly evolving market, Blackfinch has always been an adviser-facing business with a strong reputation of adviser and client support and investment expertise and strength. And above all, we listen to what adviser firms tell us.

In recent years ,there has clearly been a growing demand in the marketplace for adviser firms to own more of their own investment proposition, so they can tailor it to the values, beliefs, requirements and cultures of their client base. In other words, there are some advisor firms where a pre-defined MPS range doesn’t quite meet the needs of their clients, or where they are looking to create their own uniquely competitive investment offering.

Recognising this need led us to develop our Tailored Portfolio Service, which lets advisers determine their own investment strategy and specifications while leaving us to focus on delivering the investment outcomes for their clients.

As the name suggests, our Tailored Portfolio Service is a firm-level bespoke service where you set the specifications and we provide the resources to deliver the strategy. Unlike an MPS, which has a fixed investment strategy set by Blackfinch’s experienced team, the TPS allows you to shape your firm’s own-brand range of portfolios.

This includes many options such as mapping to a preferred risk profiler, having input to the investment process or tailoring the asset allocation. It also allows advisers to have oversight and greater control over costs.

However, whichever investment proposition you choose for your advisory business – and indeed your client base – you can be confident that the key aspects of a successful investment service are shared by the MPS and TPS propositions. But arguably the greatest incentive for using the Tailored Portfolio Service as a firm’s centralised investment proposition is the difference it could make to the valuation of advisory businesses.

By consolidating all clients’ investments into one service, adviser firms can increase their operational efficiency, provide better outcomes for their clients, and ultimately increase the value of their financial advice business.

Communication and transparency

Blackfinch is committed to full transparency and providing its investors with the highest levels of fund reporting. Therefore, both services support the demonstration of compliance with Consumer Duty legislation. For example, both services include the production of monthly investment factsheets, performance data (shown after fees) and in-depth quarterly investment reports, all of which are designed for investors and written in clear, jargon-free language.

And alongside the regular factsheets and quarterly investment reporting you can expect to receive, Blackfinch also produces an outstanding range of client-focused literature and applications designed to help investors to understand the likely investment journey that their portfolio could take.

Two distinct investment services for financial advisers

With Blackfinch’s Managed Portfolio Service now joined by its Tailored Portfolio Service, adviser firms have much greater choice in determining the most effective centralised investment proposition to suit their business, and the needs of their clients. Through both offerings, our investment team is looking forward to building exceptional portfolios and working in even closer partnership with UK adviser firms.

Interested to know more?

Whether you have an initial query or would like to speak to one of the team to discuss if MPS or if TPS is a good fit for your firm, feel free to get in touch with us at [email protected].