Managed Portfolio Service

Straightforward, Diversified Investment Portfolios with Clear, Understandable Objectives

At Blackfinch Asset Management (BFAM), our Managed Portfolio Service (MPS) delivers a range of five actively managed, globally diversified, multi-asset portfolios, designed to align with adviser objectives and evolving client needs.

With risk rated return targets, our portfolios help you meet Consumer Duty requirements while supporting holistic financial planning.

Available through multiple platforms, our MPS blends discretionary fund management (DFM) expertise with transparent communication and flexible investment solutions.

Risk Profiling

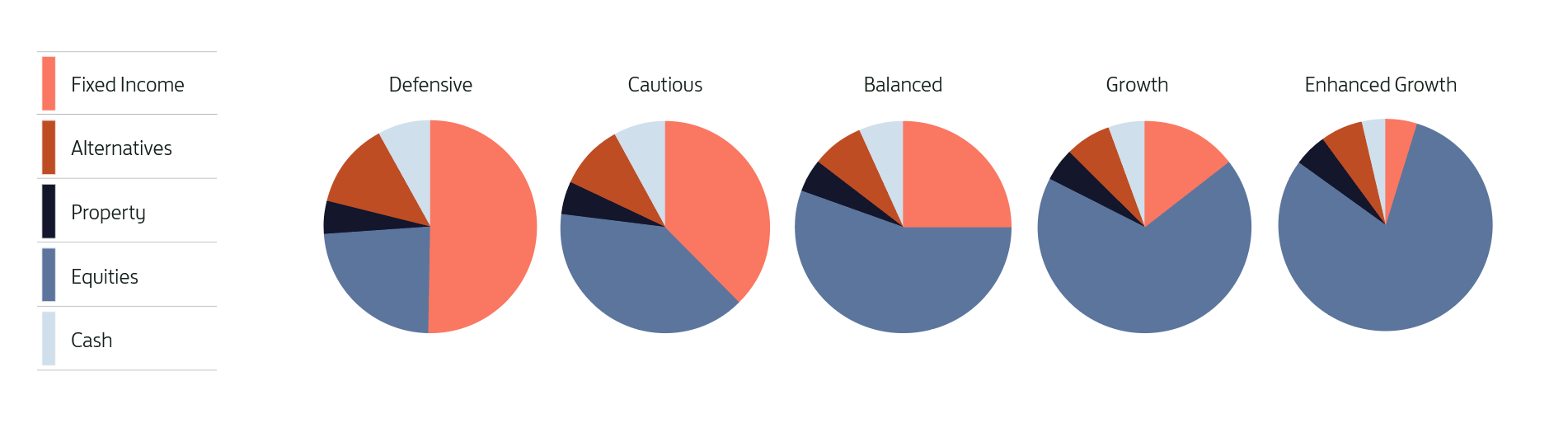

We offer five risk-rated portfolios, each benchmarked against the Investment Association Mixed Investment sectors, ensuring measurable performance and volatility comparisons.

Portfolio Name | Dynamic Planner Rating | Defaqto rating |

Defensive | 3 | 3 |

Cautious | 4 | 4 |

Balanced | 5 | 5 |

Growth | 6 | 6 |

Enhanced Growth | 7 | 7 |

Benchmarked Against Investment Association Sectors

Our MPS portfolios are benchmarked to the Investment Association Mixed Investment sectors, based on the equity allocation set within our Strategic Asset Allocation (SAA). This ensures:

- Peer group measurement for both performance and volatility.

- Transparent comparisons that help advisers and clients assess the value and success of our proposition.

Why Advisers Choose Our MPS

Adviser Benefits:

- Risk reduction: Robust screening and fund selection reduce portfolio risk.

- IA Sector Benchmark: Benchmarked against the IA Mixed Asset Sectors to support advisers with ongoing due diligence.

- Business efficiency: Provides simplified cash flow forecasting and reporting.

- Consumer Duty Requirements: Target Market and Value Market Assessment available on request to support regulatory requirements.

- Responsible Investment focus: Investments screened to align with our commitment to responsible outcomes.

DD|hub - Efficient Due Diligence

Blackfinch Asset Management's Managed Portfolio Service (MPS) is part of DD|hub, demonstrating our ongoing commitment to maintaining up-to-date due diligence information and ensuring transparency across our operations. This supports our focus on strong governance and reinforces our dedication to delivering positive outcomes for our clients.

Why Clients Value Our Portfolios

Client Benefits:

- Active management: Daily portfolio monitoring to capture growth opportunities and protect capital.

- Risk management: Multi-asset, globally diversified portfolios reduce market exposure.

- Tax efficiency: Available across ISAs, pensions, GIAs, and other tax-efficient wrappers with no minimum investment.

- Liquidity: All portfolios are fully liquid for flexibility.

- Positive impact: A responsible approach means investments aim for responsible, long-term outcomes.

Recognised by Defaqto

Our commitment to excellence is recognised by Defaqto, with a 4 Diamond Rating for DFM MPS (Platform) Portfolio Family 2026 and a 5 Star Rating for DFM MPS on Platform 2026 - evidence of our robust, adviser-focused investment solutions. Contact us to find out more.

The Blackfinch Approach to MPS

Our investment team combines top-down and bottom-up strategies, integrating active and passive underlying investment funds across a multi-asset approach. This balance of strategy and structure ensures portfolios remain resilient, well-diversified, and aligned with adviser and client expectations.

Ready to Partner with a Forward-Thinking Investment Company?

Our Managed Portfolio Service is designed to give advisers confidence, scalability, and more time to focus on clients. Whether you’re reviewing your CIP or looking for a trusted DFM partner, BFAM can help.